There have been a number of recent media reports highlighting that the 2017 Tax Cuts and Jobs Act reduced the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. bills for many U.S. corporations. Setting aside the debate over whether a low tax bill is fair, what is missed in such stories is that American businesses are critical to the tax collection system at every level of government—federal, state, and local. Businesses either pay or remit more than 93 percent of all the taxes collected by governments in the U.S. Without businesses as their taxpayers and tax collectors, American governments would not have the resources to provide even the most basic services.

In 2017, Organisation for Economic Co-operation and Development (OECD) economist Anna Milanez measured the amount of taxes that businesses in 24 countries contributed to the overall tax collection system. The U.S. was found to be one of the most “business dependent” tax systems in the industrialized world.[1]

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeThere are two ways that businesses contribute to government coffers: taxes they pay directly (their legal tax liability) and taxes they collect and pay on behalf of others (their legal tax remittance liability).

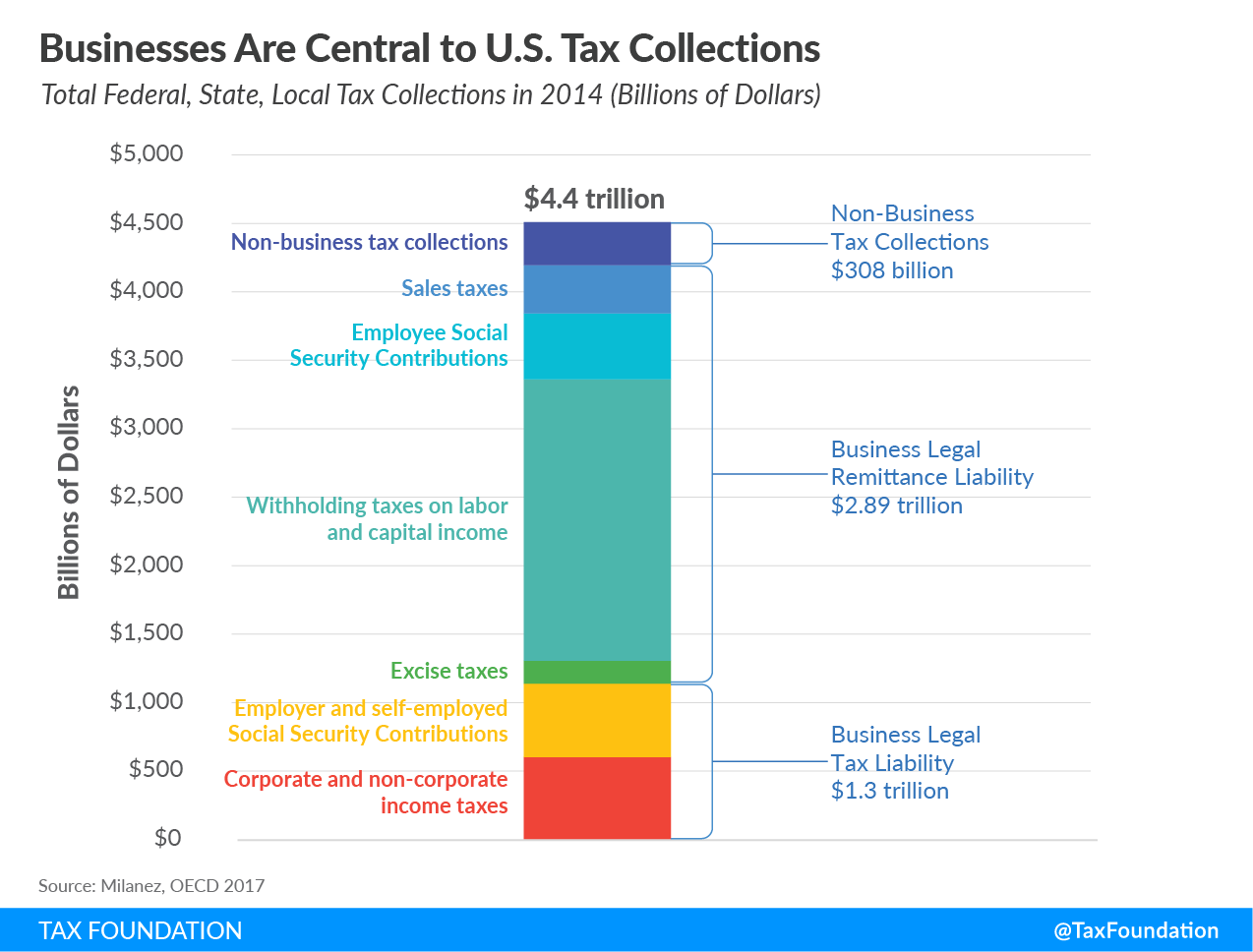

The taxes that businesses are directly liable for are corporate and noncorporate business income taxes, the employer portion of Social Security contributions (including self-employment taxes), as well as property and excise taxes.[2] As the chart shows, these taxes totaled $1.3 trillion at all levels of government in 2014. This represented nearly one-third (28.9 percent) of total tax collections in the U.S. that year.

Business income taxes were the largest category of direct taxes to government coffers. In 2014, corporations and noncorporate businesses, such as LLCs and S corporations, paid $606 billion in income taxes, or 13.5 percent of all taxes paid that year. The second-largest category of taxes paid by businesses was the employer share of Social Security taxes, which totaled $530 billion, or 11.8 percent of all taxes paid that year.[3] Excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. es paid by businesses totaled $165 billion, just 3.7 percent of all taxes.

As significant as is the direct fiscal contribution of American businesses, they play an even larger role for governments by collecting taxes and remitting them on behalf of others. The OECD study identified three main categories of remitted taxes: withholdingWithholding is the income an employer takes out of an employee’s paycheck and remits to the federal, state, and/or local government. It is calculated based on the amount of income earned, the taxpayer’s filing status, the number of allowances claimed, and any additional amount of the employee requests. taxes on labor and capital income; the employee-share of Social Security taxes; and, sales or value-added taxes (VATs).

By far, the largest of these responsibilities is withholding and remitting the income taxes that wage earners owe on their paychecks. Few, if any, salaried or hourly workers withhold money from their own paycheck and send it to the Internal Revenue Service (IRS) every two weeks. The government has placed this routine task on employers to ensure that there is a steady stream of tax payments in the government’s coffers to pay its bills. According to the OECD, withholding taxes totaled over $2 trillion in 2014, some 45.7 percent of all taxes collected that year.

While our employers are withholding income taxes on our wages, they are also deducting Social Security taxes from our paychecks and submitting those payments to the IRS on our behalf. Those payments totaled more than $479 billion in 2014, some 10.7 percent of all taxes collected.

In many countries, VAT collections and remittances dwarf most all other revenues paid by businesses, but not in the U.S. The U.S. does not have a VAT, but most states and local governments levy sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. es on the purchase of goods and some services. In 2014, U.S. firms collected and remitted roughly $354 billion in sales taxes on behalf of consumers, comprising 7.9 percent of all taxes that year.

The OECD estimated that American businesses collected and remitted nearly $2.9 trillion in taxes on behalf of workers and consumers in 2014, or 64.2 percent of all taxes levied by governments that year. Interestingly, the U.S. relies more on businesses to collect and remit taxes on workers and consumers than any other country measured by the OECD. The only country that came close to matching the U.S. was New Zealand, where remittances totaled 63 percent of overall tax collections.

When we combine the 64.2 percent share of taxes businesses collect and remit with the 28.9 share of taxes they pay directly, it totals 93.1 percent of all taxes in the U.S. collected by every level of government. According to the OECD estimates, only the Netherlands, in which businesses pay or remit 94.8 percent of all taxes, relies more on businesses as taxpayers and tax collectors than does the U.S.

The OECD figures show that businesses are essential for the collection of government revenues in the U.S. It is fair to say that governments at all levels would collapse were it not for the businesses large and small that incur considerable expenses to pay, collect, and remit taxes on behalf of themselves and other taxpayers.

The OECD data shows that governments in the U.S. have structured the tax system to effectively shift the lion’s share of the cost of complying and administering the cost of the tax system to private businesses. It would be difficult to calculate how many tax collectors governments would have to hire to replace the efforts of the more than 35 million businesses in America that perform tax collection and payment services on behalf of government. These substantial compliance costs should not be forgotten when we consider whether businesses pay their fair share of taxes.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] For more detail on the Milanez study, see Scott A. Hodge, “Contrary to ‘Fair Share’ Claims, Businesses are Central to Tax Collection Systems,” Tax Foundation, May 16, 2018, https://taxfoundation.org/fair-share-businesses-central-to-tax-collections/.

[2] Milanez was unable to estimate property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. payments for U.S. businesses because of data constraints. For all other countries, property taxes on businesses contributed an average of 1.1 percent of total collections. See Anna Milanez, “Legal Tax Liability, Legal Remittance Responsibility and Tax IncidenceTax incidence is a measure of who ultimately pays a tax, either directly or through the tax burden. This burden can be split between buyers and consumers, or different groups in the economy. : Three Dimensions of Business Taxation,” OECD Tax Working Papers No. 32, 2017, 32, https://www.oecd-ilibrary.org/docserver/e7ced3ea-en.pdf?expires=1556811960&id=id&accname=guest&checksum=FDDAD82CC8C9502707C7909211460050.

[3] In this instance, Milanez is only measuring the legal incidence of payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. es, the portion directly paid by businesses. In a later chapter, she discusses the economic incidence of Social Security taxes, which largely fall on workers in the form of lower wages.

Share