This week, economists Natasha Sarin and Lawrence Summers published a piece arguing that the Internal Revenue Service (IRS) may be able to raise up to $1 trillion in revenue over 10 years by improving taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. compliance. The authors’ thoughtful recommendations to boost compliance can be strengthened by better tax policy. A simpler, more economically sound tax policy would encourage taxpayers to comply with the tax code and improve trust in the tax system.

Sarin and Summers examined the federal tax gap, which is the difference between taxes paid and taxes owed to the federal government. The gross tax gapThe tax gap is the difference between taxes legally owed and taxes collected. The gross tax gap in the U.S. accounts for at least 1 billion in lost revenue each year, according to the latest estimate by the IRS (2011 to 2013), suggesting a voluntary taxpayer compliance rate of 83.6 percent. The net tax gap is calculated by subtracting late tax collections from the gross tax gap: from 2011 to 2013, the average net gap was around 1 billion. accounts for at least $441 billion in lost revenue each year, according to the latest estimate by the IRS for the 2011 to 2013 tax years. This implies a voluntarily compliance rate of 83.6 percent.

The authors point to three areas of reform to close the tax gap by up to 15 percent: increase the proportion of tax returns that are examined by the IRS by increasing enforcement resources, improve information reporting requirements for sources of income that are opaque (such as self-employment income), and modernize the IRS’ information technology infrastructure to better identify errors in tax returns.

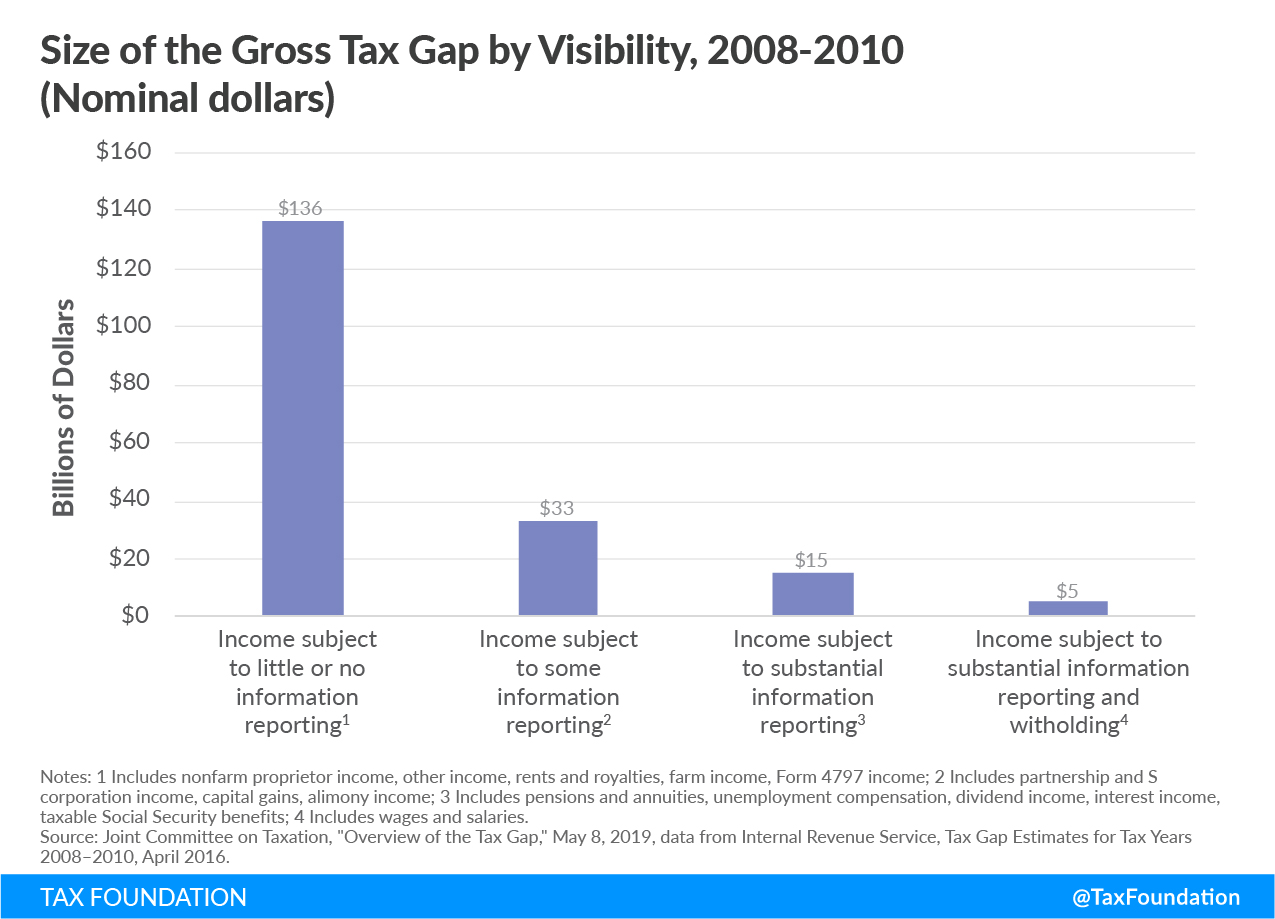

Each of these recommendations would help improve tax compliance and strengthen the IRS’ ability to enforce the tax code as it exists. For example, as Sarin and Summers note, sources of income that are not subject to reporting requirements or withholdingWithholding is the income an employer takes out of an employee’s paycheck and remits to the federal, state, and/or local government. It is calculated based on the amount of income earned, the taxpayer’s filing status, the number of allowances claimed, and any additional amount of the employee requests. , such as income earned by sole proprietors or independent contractors, is disproportionately responsible for the tax gap when compared to reported income such as employee wages. Improving reporting requirements would provide more transparency to tax authorities and to taxpayers who may not understand their tax liability. Sarin and Summers estimate that this would raise an additional $350 billion in revenue over 10 years.

Likewise, an IRS with a more robust budget for examining tax returns and enforcing the tax code would better identify unreported or misreported income, raising federal revenue. The IRS enforcement budget has dropped by 25 percent since 2011, which reflects a 45 percent decline in the number of returns examined in that time period. Sarin and Summers estimate that restoring auditA tax audit is when the Internal Revenue Service (IRS) conducts a formal investigation of financial information to verify an individual or corporation has accurately reported and paid their taxes. Selection can be at random, or due to unusual deductions or income reported on a tax return. rates to 2011 levels would raise about $715.5 billion over 10 years if the agency focused on high-income taxpayers, corporate tax filers, estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. filers, and self-employed taxpayers.

Closing the tax gap is a worthy goal as doing so would improve trust in the tax system; taxpayers would know that their neighbors are also complying under the same set of tax rules. It would also raise revenue that would otherwise be raised by increasing tax rates or broadening the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. . Closing the tax gap would be easier, however, if tax policy did not encourage taxpayers to take advantage of tax preferences or misrepresent income in the expectations of lower tax rates.

For example, the top tax rate on long-term capital gains and qualified dividends of 23.8 percent is lower than the top marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. on ordinary income of 40.8 percent. This differential encourages taxpayers to misrepresent their labor income as capital income in the pursuit of a lower tax rate, despite IRS rules guiding how to treat these different sources of income.

The preferential tax rates on business income and capital gains relieves taxpayers of double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. through the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. and the way the tax code is biased against saving and investment. If these two aspects of the tax code were fixed—such as by integrating the corporate and individual income taxes and treating investment neutrally to consumption—preferential rates may not be needed, and taxpayers would not be encouraged to misclassify income to get a lower tax rate.

Tax complexity may also contribute to the tax gap, as taxpayers must navigate tax rules and forms to properly report income and calculate the taxes they owe. Americans spend over 8.1 billion hours on tax compliance, and there is evidence that complexity drives a large part of the tax gap for self-employed workers and independent contractors, as these taxpayers may not know how to properly report and remit income and self-employment tax.

Efforts to bolster tax enforcement and compliance are worthy policy goals that would be strengthened with a simpler tax code that removes tax preferences that encourage taxpayers to misreport their taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. . A tax code with a broader base and lower rates would lower tax evasion in addition to avoidance, closing the tax gap and making federal tax collections more efficient.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe