This week, the Trump administration is expected to release a plan to encourage more infrastructure-related projects. A new White House budget proposal allocates almost $200 billion of existing infrastructure spending to new projects over the next decade. The plan does not, however, address the current Highway Trust Fund’s shortfall, which in 2016 was projected to become insolvent by 2021. Recently, the U.S. Chamber of Commerce has proposed raising the gas tax by 25 cents per gallon, which has been one of the most straightforward ways to raise revenue for transportation funding. However, before the gas taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. is considered a long-term policy solution it’s worth discussing the tax’s most significant existential threat: electric vehicles.

The gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. is a fairly well-designed tax that aims to achieve two main goals. The first is to capture the negative externalities caused by driving gas-burning motor vehicles. Internal combustion engines can be loud and dirty, and a gas tax would ideally offset their cost to society. Taxes that target market activity which generate negative externalities are called Pigouvian taxA Pigouvian tax, named after 1920 British economist Arthur C. Pigou, is a tax on a market transaction that creates a negative externality, or an additional cost, borne by individuals not directly involved in the transaction. Examples include tobacco taxes, sugar taxes, and carbon taxes. es. From the Pigouvian perspective, the gas tax is one of the best policy options used to mitigate the externalities associated with automotive transit.

The second main goal of the gas tax is to act as a user feeA user fee is a charge imposed by the government for the primary purpose of covering the cost of providing a service, directly raising funds from the people who benefit from the particular public good or service being provided. A user fee is not a tax, though some taxes may be labeled as user fees or closely resemble them. . According to the “benefits principle,” someone who uses the highway system ought to be liable to pay for the benefit derived. This means that the gas tax would ideally tax drivers based on the proportionate damage they do to the roads. Additionally, since road space is limited and rivalrous, one driver’s use of roads could potentially exclude others. User fees act to eliminate crowding, ensuring only those with the highest utility see it worthwhile to pay the gas tax in order to drive.

A challenge with the gas tax stems from its attempt to accomplish multiple competing objectives. The gas tax’s Pigouvian goals may be too successful, meaning the gas tax may actually be shifting consumer preferences to alternative fuel vehicles, undermining its own base. In addition, other regulations such as the Corporate Average Fuel Economy (CAFE) standards and tax incentives like the Qualified Plug-In Electric Vehicle (PEV) Tax Credit have also encouraged the switch to alternative fuel vehicles. Using the gas tax as a user fee will be increasingly challenging as more electric and fuel-efficient vehicles are produced. Since current policy seeks to expedite the adoption of more efficient vehicles, the gas tax will become less effective at raising revenue over time by design.

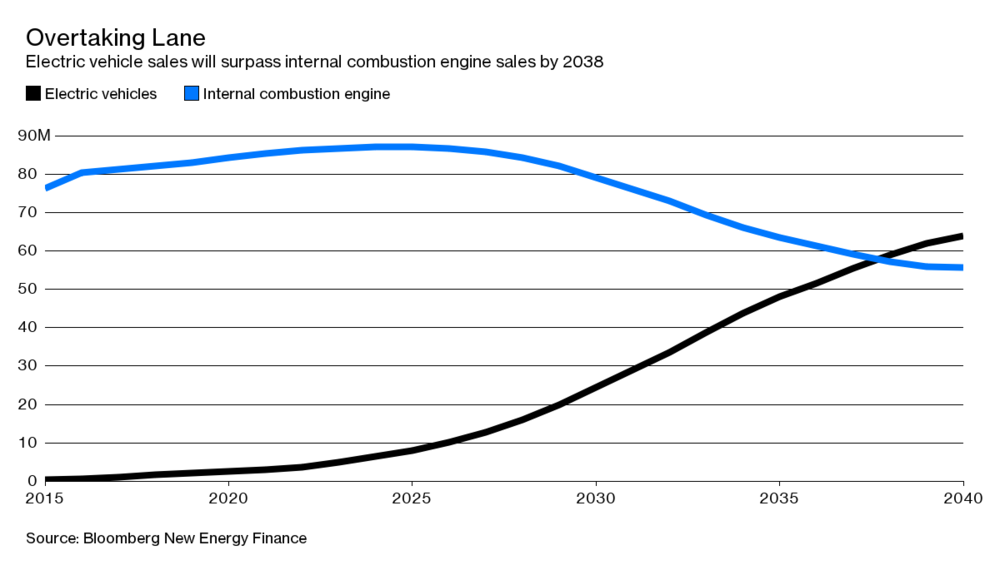

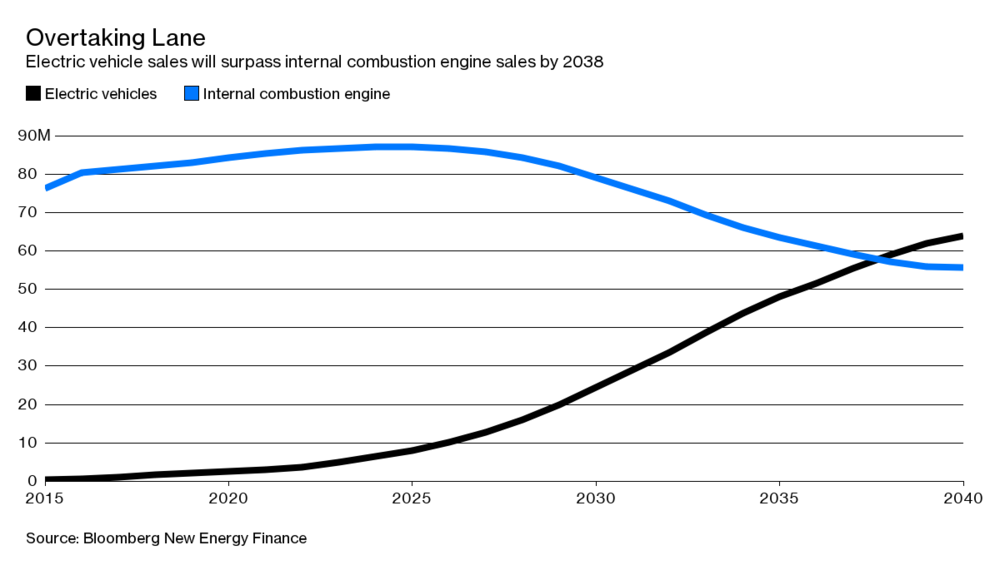

While the gas tax may be a suitable policy tool now, as there are currently only about 2 million electric vehicles worldwide, new predictive models such as the Bloomberg New Energy Finance (BNEF) forecast predict that comparable electric vehicles may be as cheap as gasoline vehicles by 2025. Additionally, electric vehicle sales are forecast to overtake traditional internal combustion engine vehicle sales by 2038. The market for heavy-duty vehicles is similarly being shaken up by electric vehicles, with recent announcements from Tesla regarding their Tesla Semi causing rival automotive manufacturers to similarly announce plans.

Alternative, and more direct forms of user fees, have “emerged as the consensus choice for the future” according to the National Surface Transportation Infrastructure Financing Commission. Proposals such as vehicle miles traveled (VMT) taxes could work as sustainable sources of revenue for infrastructure spending projects in the wake of increasingly fuel-efficient and electric vehicles, though a number of logistical and administrative questions would need to be answered before adopting the new tax. Also, high-occupancy toll (HOT) lanes and congestion fees such as the London congestion charge could serve as viable alternatives to the gas tax in the coming decades.

Lawmakers are anticipating a new focus on infrastructure-related programs which may require new sources of revenue. For a truly long-term solution for infrastructure spending in the United States, policymakers will have to seriously consider alternatives to raising the gas tax or figure out a way to lower overall infrastructure costs.

Share